Robert Triggs / Android Authority

TL;DR

- According to a new report, Apple saw huge growth in the $400+ smartphone segment between Q2 2020 and Q2 2021.

- The firm reportedly claimed nearly 75% of sales in the flagship $800+ price band, too.

- Its biggest Android rivals, Samsung and Huawei, struggled to keep pace. Xiaomi and Oppo, however, saw noticeable gains.

Apple just launched the iPhone 13 series, but the company has its outgoing model line to thank for its booming success in the premium smartphone market. According to new data, the firm has claimed an even larger share in the premium smartphone segment this year at the expense of its Android rivals.

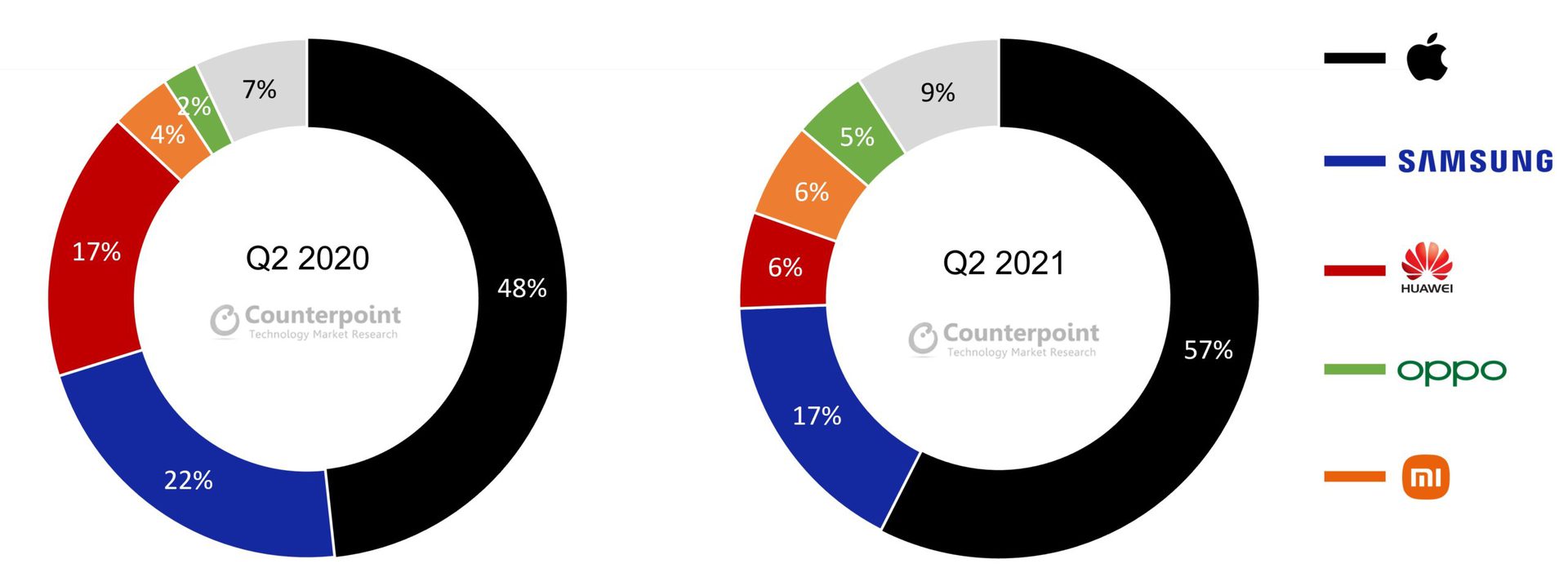

Per a new report from Counterpoint, Apple’s global premium market share grew from 48% in Q2 2020 to 57% in Q2 2021, largely off the back of the iPhone 12 series’ success. Notably, Counterpoint defines the premium market segment as devices retailing over $400, including the lion’s share of Apple devices. That said, its performance in the ultra-premium ($800 or above) segment is also particularly notable.

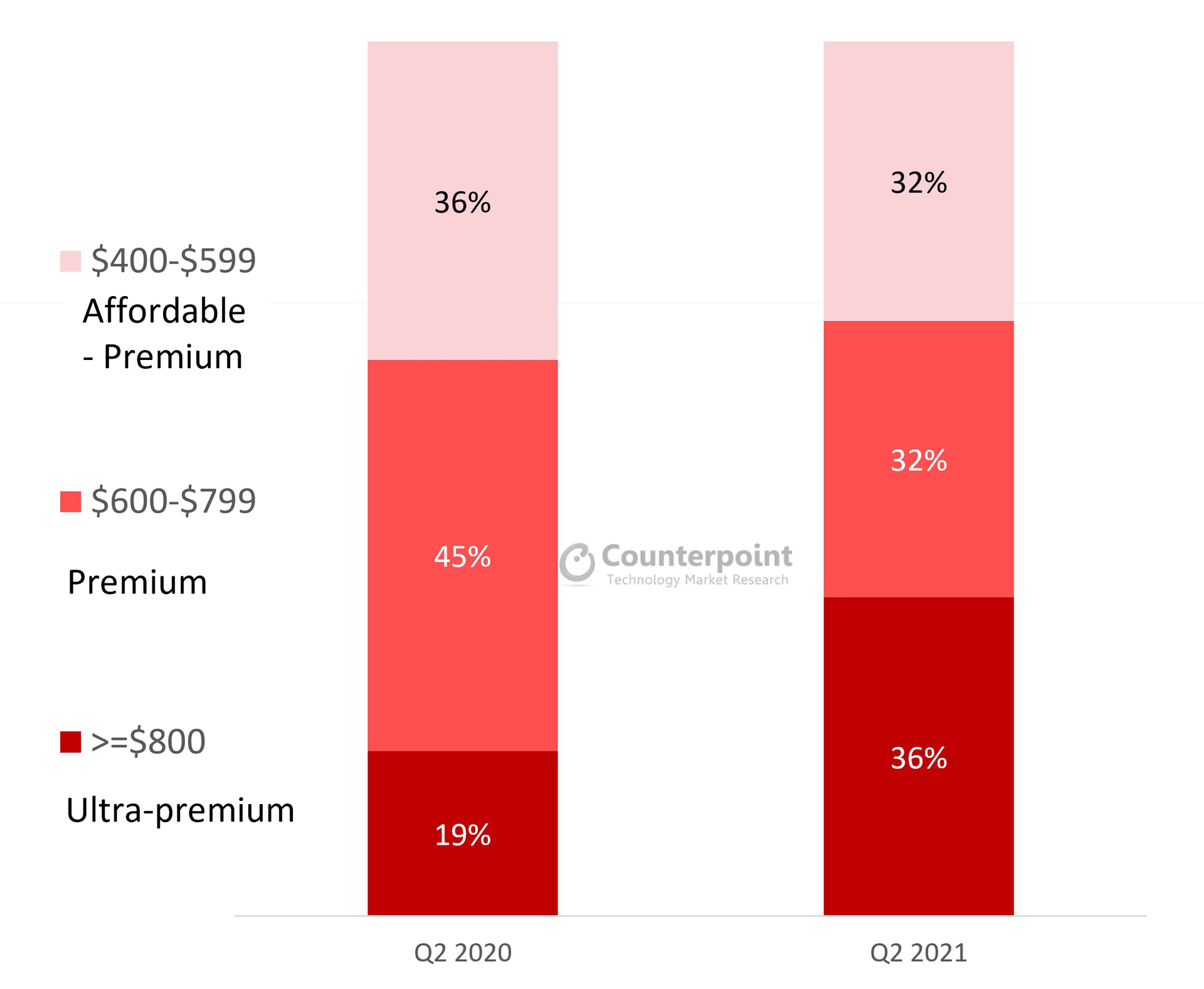

Across the entire premium smartphone market, this specific price band accounted for 36% of premium smartphone sales in Q1 2021 — a growth of 182% year-over-year. Apple accounted for nearly three-quarters of the sales in this band in Q2 2021, up from 54% a year prior. Again, this figure was buoyed by the iPhone 12 Pro and iPhone 12 Pro Max‘s sales performance, per Counterpoint.

How did Apple’s Android rivals perform?

Android OEMs struggled to keep pace with Apple in the premium segment.

Samsung hung on to 22% of the premium market in Q2 2020, but this share dropped to 17% in Q2 2021. Counterpoint blames this decline on supply constraints. Nevertheless, in terms of volume, Samsung still saw a 13% sales increase in the premium category over this period.

Despite its continued troubles in Western markets, Huawei remains the third biggest global smartphone vendor in the premium category. However, it saw a steep share decline, falling to 6% in Q2 2021 from 17% in Q2 2020. Notably, its position is largely due to its residual strength in the Chinese market, where it still ranks as the second biggest OEM in the premium segment.

Only two Android OEMs displayed notable market share gains over the period, namely Oppo and Xiaomi. The latter grew its premium stake from 4% to 6% between Q2 2020 and Q2 2021, adding to its success across all pricing bands in Q2 2021. Meanwhile, Oppo experienced double-digit share growth in the premium segment, from 2% to 5% over the same period.

More reading: Now that Xiaomi is number one, can it stay ahead of Samsung?

Other Android smartphone makers are slowly joining the big four in the premium segment. OnePlus ranked as the third biggest OEM in this sector in North America, largely thanks to the OnePlus 9 series. Vivo also holds this rank in the APAC region, behind Apple and Samsung. Motorola continues its strength in the Latin American market as the third-largest premium device OEM behind Apple and Samsung in this region.

Looking ahead to H2 2021, Counterpoint suggests Samsung will claw back some market share with the cheaper Galaxy Z Fold 3 and Galaxy Z Flip 3 flagships. Xiaomi, now ranked as the world’s biggest smartphone maker in June 2021, continues to push more premium products to market, too.

As the pandemic slowly subsides, it’s unclear how this will affect consumer’s buying habits, or whether they’ll hang on to the premium devices they currently own. That said, the iPhone 13 series doesn’t seem to be as large an upgrade over the iPhone 12 line. Whether this affects Apple’s dominance remains to be seen.