Though this year is by no means one to celebrate, there were still some bright spots in the world of tech. It’s with plenty of loathing that we admit this: NFTs somehow won this year. They’ve taken over. Reddit’s day traders also deserve recognition for the way they’ve managed to manifest GameStop’s slogan, “Power to the players.”

Also (and this might be the most painful to acknowledge), the Metaverse (sorta) took off this year. At least in terms of our lexicon, with mentions of the word skyrocketing since Mark Zuckerberg uttered it while announcing plan for a richer VR and AR-focused world. Maybe people were confused between “metaverse” and “multiverse” as in Dr. Strange in the Multiverse of Madness?

Besides the things we love to hate, there are some products this year we genuinely liked as well. Apple continued to impress with its M1 chips and, more importantly, gave users a way to repair their own devices (kinda). Google’s first-ever mobile chip powered clever experiences on the latest Pixel phones and showcased the company’s AI and software prowess at a competitive price. As we continue to be bombarded by depressing news every day, it’s worth taking the time to reflect on the wins this year, no matter how tiny.

Noam Galai via Getty Images

NFTs

2021 has not been a quiet year, so NFTs deserve something approaching praise for securing a spot in the highlights reel. NFTs, or Non-Fungible Tokens, are an attempt to create an immutable digital asset in an environment where such a thing has historically been tricky. For the industry’s proponents, it’s a way of imposing some form of scarcity on digital artifacts that you can’t easily make scarce. Anyone can right-click and save a picture of a monkey wearing sunglasses and a Hawaiian shirt after all. But only the person who paid a lot of money for the NFT can go around calling themselves the “owner” of the same. As Nietzche didn’t say, NFTs are the lie agreed upon, suggesting that people respect the owner of the certificated copy of something over everything else.

So far, the biggest and most notable moves in the NFT space have happened in the art market, with pieces being bought and sold for eye-watering numbers. On March 11th, digital artist Beeple sold Everydays: The First 5,000 Days at Christie’s auction house for $69,346,250. Those hefty sums are, in some people’s minds, justified because they believe that NFTs will become the new crypto, with everyone trying to get aboard the bandwagon before it goes big. After all, there are lots of folks who got rich during the Bitcoin boom that want to further enhance their fortunes, while some who were left behind now hope to get in on the ground floor on the next big thing. Others, meanwhile, think that the big craze in NFTs right now is to help folks move large quantities of money around away from the auspices of, you know, regulators.

The NFT market is so awash with speculator cash that it’s normal to have… questions. A recent Harvard Business Review article talks about how commerce can’t work without “clear property rights,” which NFTs help to impose. There’s also the matter of whether NFTs could better enable more reliable and secure ticketing and permission systems? I’ll be honest, I’m personally unconvinced by the argument that NFTs offer rights of ownership, since they don’t necessarily confer upon the buyer the proper rights of ownership.

These issues are, however, going to be worked out over the next few years, and it will only be when the speculation has died down that we’ll see if NFTs have any residual worth. And, hey, not every deeply-technical cryptographic ownership record gets their own SNL sketch shortly after they broke into the mainstream, do they.

— Daniel Cooper

Mark Zuckerberg didn’t invent the term, but by rebadging Facebook as “Meta,” he helped kick off a wave of interest in the metaverse. While it was originally a dystopian view of cyberspace via Neal Stephenson’s Snow Crash, the metaverse now represents the next big online goldrush. You can think of it as the logical step forward from the mobile internet, a world where our online experiences can easily transition between multiple devices. And eventually, it could be something we interact with via AR and VR glasses.

To be clear, we still don’t have an exact idea of what the metaverse will be. The Meta renaming could easily be seen as a way for Zuckerberg to avoid his responsibilities as the leader of a fundamentally broken social media company. But other companies have been exploring this idea for years: Microsoft’s HoloLens has proven to be surprisingly useful for commercial and front-line workers, and it’s also core to Mesh, the company’s ambitious solution for virtual meetings. The Borg-like Google Glass was widely ridiculed, but its failure hasn’t stopped Google from thinking about its role in the metaverse, either.

Maybe it’ll take a killer new device, like Apple’s fabled AR glasses, to bring the metaverse into focus. Or maybe it’ll go the way of wearables — a category of devices that’s useful for some people, but not necessarily essential for everyone. Either way, it’s something that will forever be tied to 2021.

— Devindra Hardawar

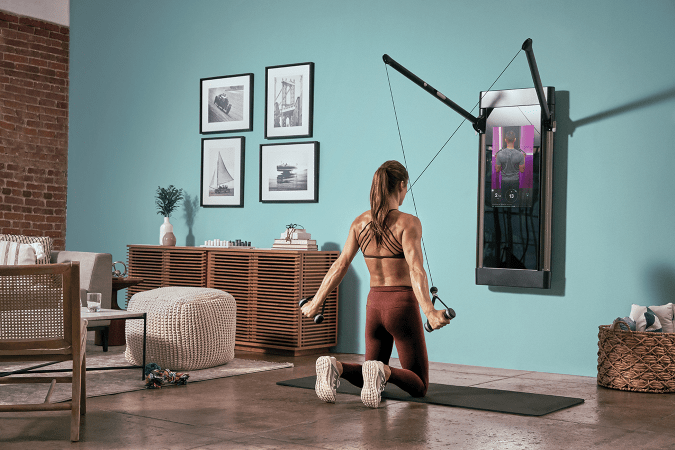

Home fitness tech is here to stay

As the pandemic kept many of us indoors and out of gyms, companies like Peloton, Apple, Tonal and even Amazon were able to pull us into new fitness habits and equipment.

Apple

Meanwhile, major fitness studios and gyms like Equinox, Soulcycle, OrangeTheory and F45 have modulated (while some created from scratch) their online services. Many companies expanded replayable class options or added live lessons, leaderboards and more in a bid to keep members fit – and keep those membership dues coming in.

COVID-19 offered a chance to shift our workout habits and reduce gym costs. Why pay $50 for a high-intensity interval training gym membership when I can track myself in Apple’s Fitness Plus classes, SharePlay with my friends and jump in my own shower, all for just $10 a month?

Of course, the comparison isn’t oranges for oranges, and despite cheerleading Peloton trainers and form corrections from gym coaches over video livestreams, it’s very hard to get the degree of attention gained from in-person training. That’s likely one reason why at-home exercise injuries have never been higher. The Wall Street Journal reported that emergency room visits after home workouts increased by more than 48% from the end of 2019 through the end of 2020, according to a survey by Medicare Advantage.

However, just like traditional gyms did when the pandemic first hit, these businesses have to figure out how to hold onto their customers.

Tonal

Tonal is a ‘Peloton for weight training’ product that Engadget tested back in 2018. When our usual bench-press machines and squat racks were locked inside gyms over the last year and a half, Tonal saw demand for its resistance-training system rocket. Sales grew more than eight times year-over-year. In a bid to hold onto these new customers, the company recently introduced live classes for Tonal owners, with direct feedback from coaches and classes reportedly calibrated for each user.

Meanwhile, Peloton, arguably the most recognizable at-home fitness company, faces more competition from (and litigation with) rivals and a tougher business outlook. After a rough earnings report in November, the company said it didn’t expect to be profitable again until 2023. Worse, its Bike was involved in the death of an important character in the Sex and the City reboot, And Just Like That. But the company has plans (and cheeky responses). It’s integrated into many corporate fitness plans, launched its first exercise game, announced a fitness camera for strength training and finally — added a pause button.

The challenge will be keeping many of us from returning to our old gyms, cycling commutes, or our old, less healthy habits when things eventually return to normal.

— Mat Smith